What Are SSDI & SSI Benefits?

Home » What Are SSDI & SSI Benefits?

Social Security Disability Benefits: SSDI & SSI

Social Security Disability Insurance (SSDI) is a program that pays a monthly benefit for individuals with disabilities who have paid into Social Security by working a job and earning “work credits”. People who qualify typically have worked a job or jobs for multiple years prior to the onset of their disability.

Supplemental Security Income (SSI) is designed to help people with disabilities pay for their basic living expenses. The monthly benefits for SSI are funded by taxes rather than Social Security. This means that you do not have to verify a work history to qualify.

Some people will only be eligible for one program or the other, but some people will qualify for both. For more on these Social Security disability benefits programs, please see our article and explainer video: What is The Difference Between SSDI & SSI?

Ongoing Disability Benefits

If you qualify for SSDI or SSI, you can receive monthly income for as long as you remain eligible. SSDI stops at full retirement age, replaced by regular Social Security retirement benefits. SSI can continue past full retirement age.

Also, after a waiting period, SSDI and SSI recipients get access to healthcare coverage, such as Medicaid or Medicare, which may help to cover past and future medical care.

The current maximum monthly benefit for SSDI is $3,345 (as of September, 2024).

What We Do

Citizens Disability helps eligible individuals apply for Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI). Accessing these benefits on your own can be a complex, lengthy, and difficult process – but we are here to ease your burden.

If you or someone you know has been unable to work for 12 months (or is expected to be out of work for 12 months or) or more because of a disabling condition or qualifying impairments, we may be able to help. Our initial consultation is at no cost to you – click here to begin your free screening.

Our Disability Advocacy Services

Our knowledgeable team consists of specialists and advocates that have many years of experience helping people like you get the disability insurance benefits, like SSDI and SSI, they may be entitled to. Our combined experience and deep knowledge of the application process uniquely positions us to help secure disability insurance benefits for the eligible individuals we help and represent.

Why Citizens Disability?

- No fee, unless you win your benefits. We don’t get paid unless you do.

- We represent individuals at every stage of the process, including hearings.

- We will increase your odds at winning benefits vs doing it alone by up to three times.

Get More Information on SSDI & SSI

Social Security Disability Insurance is a complicated and complex topic, with a variety of rules and regulations. It’s normal to have lots of questions, and to want to get answers. Citizens Disability exists to help people navigate their way through this difficult application process. We’re happy to explain as much as we can to prospective claimants and the people we serve through our advocacy.

Click the tabs below to read more, and find links to our collection of articles and explainers. If you’re ready to file a claim and would like us to help you, take our instant case evaluator, and we’ll call you!

We look forward to speaking with you.

Overview of Social Security Disability Benefits: SSDI & SSI

Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) are two programs offered and managed by the Social Security Administration (SSA).

You may qualify for one or both of these benefits if you have a diagnosed medical disability that is expected to last longer than 12 months that will prevent you from doing “substantial gainful activity.”

Navigating the world of Social Security by yourself can be a challenging and frustrating process. If you are unable to work due to sickness or injury, it may feel very difficult for you to find answers and get the help you need. Understanding the different programs and knowing if you qualify is an important first step to getting your claim approved. Citizens Disability makes it easy for you to learn about what options you have with social security.

What is the difference between SSDI and SSI?

Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) are services managed by the Social Security Administration, and both are aimed at helping disabled individuals with financial assistance. However, beyond those similarities, the programs are quite different.

SSI was created to help individuals who have very limited financial assets and may have a difficult time paying for basic necessities due to disability or blindness. Some people who are eligible for SSDI may also be eligible for SSI, as well.

SSDI, on the other hand, is an “earned benefit” that is available to individuals under full retirement age who are deemed too disabled to work. Because it is an earned benefit, the amount each individual may receive from SSDI is dependent upon their earnings record – the more income an individual previously earned, the higher their benefit will be. By contrast, SSI is a relatively fixed benefit and may actually be reduced if the recipient receives other income.

Who qualifies for Social Security Disability?

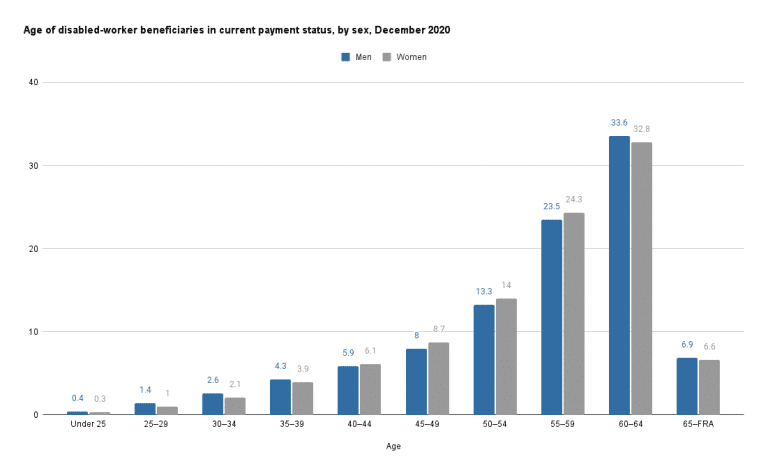

Anyone under full retirement age who has paid into Social Security for at least 5 years out of the last 10 (even if they were not consecutive years) may qualify for SSDI. Although most award recipients are between the ages of 50 and 63, anyone who has the appropriate number of “work credits” may qualify.

All applicants for SSDI must have a medically diagnosed disability, which prevents them from sustaining work – substantial gainful activity – for at least 12 months.

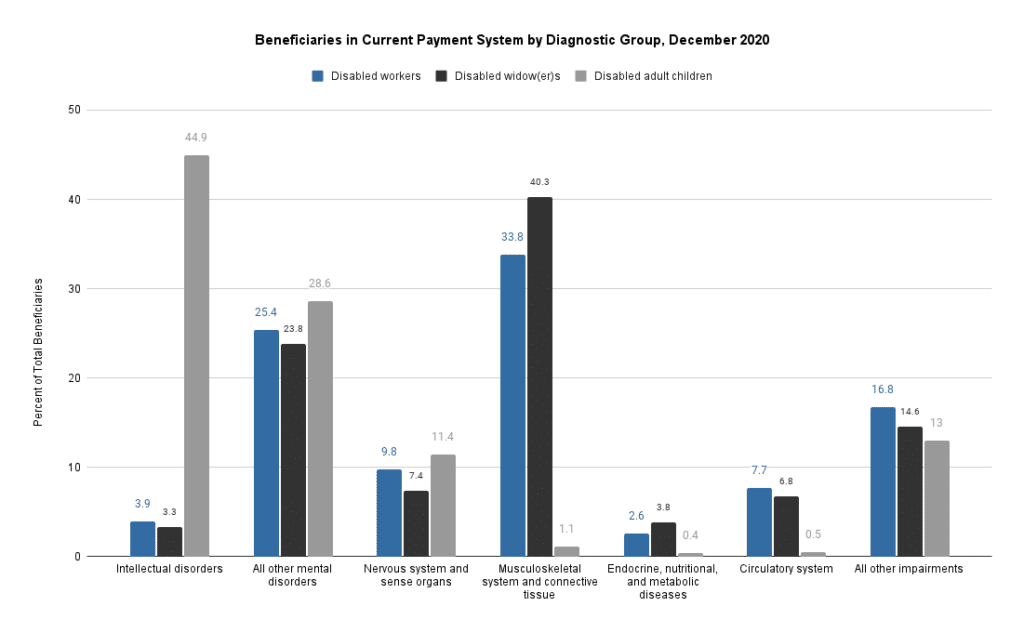

As part of the application process, you may be required to submit medical records verifying your condition(s). Not all medical conditions will qualify you for SSDI, however. You must demonstrate that your conditions, alone or combined together, are a severe impairment.

Disability Overview - Definition of Disability

It’s important to understand that the definition of disability from the Social Security Administration is a bit different from that used by other disability programs. The Social Security Administration pays benefits only for total disability. It does not pay benefits for partial disability or short-term disability.

Section 223(d)(1) of the Social Security Act defines a disability as:

(A) the inability to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment which can be expected to result in death or which has lasted or can be expected to last for a continuous period of not less than 12 months, OR

(B) in the case of an individual who has attained the age of 55 and is blind (within the meaning of blindness as defined in section 216(i)(1)), inability by reason of such blindness to engage in substantial gainful activity requiring skills or abilities comparable to those of any gainful activity in which the individual has previously engaged with some regularity and over a substantial period of time.

When considering Substantial Gainful Activity, the Social Security Administration (SSA) isn’t concerned just about money, buts also about the type of work being done.

A medically determinable physical or mental impairment is an impairment that results from anatomical, physiological, or psychological abnormalities that can be shown by medically acceptable clinical and laboratory diagnostic techniques. An impairment must be established by medical evidence consisting of signs, symptoms, and laboratory findings.

To be eligible for disability benefits one must:

- be insured for Social Security benefits

- be younger than full retirement age

- “meet or equal” a Social Security defined disability.

Meeting the insured requirement means that a person must have worked long enough, and recently enough under Social Security. The number of work credits (quarters of coverage) one needs to qualify for disability benefits depends on the individual’s age when he or she becomes disabled.

Linda Cosme formerly served as a Member of the Appeals Council (AC) for the Social Security Administration (SSA), and Program Expert for the Social Security Administration and Disability Quality Branch (DQB). Ms. Cosme also served as a Quality Assurance (QA) Reviewer, Initial Disability Examiner, Reconsideration Disability Examiner, and Continuing Disability Examiner (CDR) for the Disability Determination Services (DDS). She is admitted to practice law in Arizona, Georgia, and the United States Ninth Circuit Court of Appeals.

It is easy to get started.

It is easy to get started. No upfront costs – You only pay if we win!

Oops! We could not locate your form.